Getting ready to object – the analysis

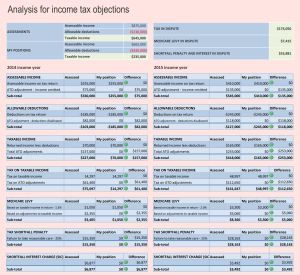

A key stage in objecting to an assessment is analysing it. The notice of objection is then based on the key numbers drawn from the analysis (see numbers in bold in the analysis in What an analysis might look like below).

The Tax Objection prepares these analyses but is always helpful if the tax agent of the taxpayer prepares an analysis too to give further insight into and understanding, as a comparative, about the tax liabilities assessed.

Example – amended assessments received by a resident individual

You have received two notices of amended assessment for a resident individual from the Australian Taxation Office which show a hike in taxable income for the 2014 and 2015 years and an increase in tax liability. Not only has taxable income increased but there is an increase in medicare levy (that goes up with taxable income), and shortfall penalty and shortfall interest have been imposed.

The notices have scant information about why assessable income and allowable deductions numbers for these years have been amended, explain how and by when the amended assessment needs to be paid and remind the taxpayer of the right to object if dissatisfied with the amended assessment.

Amendments by the Commissioner are disputed

You don’t accept that the amendments have been correctly made in the notices and you believe the original assessments, which were based on the income tax returns you prepared, remain correct.

If an objection to the amended assessments is viable, then we can do the analysis of the amended assessments to identify:

- whether there really is a dispute justifying an objection;

- what that dispute is, or what they are; and

- the tax dollars hanging on what is in dispute.

We can then understand the importance of the relevant arguments and facts and their impact on the possible tax dollar outcomes. Disputing an assessment has a cost so the viability of the objection turns on there being reasonable prospects that the objection can decrease the assessment liability by more than that cost.

What an analysis might look like

The analysis can be done in a number of ways. A spreadsheet is a very useful tool in performing the analysis. For example:

The analysis is an insight in to the amended assessments and the reasoning behind the amended assessments giving understanding of them as a whole numerically and in context.

The analysis reveals if the taxpayer has a case

In the above example, it can be seen that the amended assessments arise from specific increases in assessable income and specific disallowances of allowable deductions. It is those specific increases and disallowances that need to be carefully considered to understand whether the taxpayer can gather the facts and evidence needed to ground a challenge to the amended assessments. It could be that the taxpayer only has reasonable prospects of success in relation to some of the adjustments made by the Commissioner and so that should be reflected in the analysis and taken into account in working out whether an objection is feasible.

No comments yet.