Following a pilot program and formative adoption of the in house facilitation process, the ATO has introduced specific guidelines including:

- a precise IHF process template; and

- a statement of expectations from the IHF;

for in house facilitation (IHF) of tax disputes with the ATO. The ATO offers IHF as a general means of mediation of tax disputes where the facilitator (mediator) is an ATO officer.

Getting serious about dispute resolution with in house facilitation

IHF can be a valuable alternative to a taxpayer with a dispute with the ATO. So the move to entrench a correct structure of the facilitation process is to be welcomed. This should overcome the reluctance and non-adherence by some ATO officers who have come less than well prepared and committed to altenative dispute resolution in the formative IHF processes experienced by some taxpayers so far.

Honing the facts and issues in a dispute and saving costs

Indeed one significant benefit to a taxpayer of using IHF should be to normalize how an ATO case officer is dealing with their problem. A case officer may be fixated on a matter or series of matters which are divergent with a taxpayer’s understandings or divergent with the facts understood to be relevant to the taxpayer. IHF can be a real opportunity to engage with and even press the case officer and maybe his or her leadership. That engagement is with the aid of a somewhat detached ATO facilitator in an effort to reach a common or improved understanding of the relevant facts and issues. Even if that facilitation doesn’t result in a final determination of the dispute, it can, at least, lead to a narrowing of issues in dispute. A big reduction in the ultimate cost and effort of resolving the dispute can follow.

Contrast with position paper exchange

IHF is aimed at, and available only to, individual and small business taxpayers. Not all disputes are complex enough, or have tax at stake, which justify the ATO committing resources to preparing a paper setting out their position. With IHF generally available the opportunity is there for both sides to put their positions without going through a time-consuming sequence of preparing and exchanging position papers and responses. If a taxpayer and the ATO observe the entrenched IHF process and the statement of expectations, and are both well prepared at an IHF session, both parties should leave the IHF with a better understanding and honing of the matters in dispute, if not a resolution.

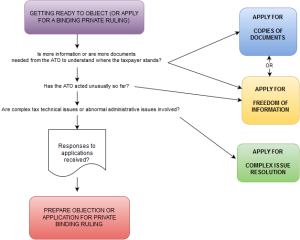

IHF – an open-ended offering

That is not to say that a taxpayer should not pursue IHF and exchange position papers with the ATO too. The ATO offers IHF during and following audit, after audit and after an assessment is raised, before and after an objection is lodged and before or and after an appeal to a tribunal or court is sought. In the latter cases a facilitation may have limited use to a taxpayer because of its interaction with time limits for objections and appeals and the availability of mediation facilities outside of the ATO offered once the matter reaches a tribunal or a court.

Like with a position paper, the best time to pursue IHF will usually be before an assessment is raised, if that is possible. That is the best chance of being before the ATO has a view it wishes to entrench and defend.

Timing of engagement

IHF thus offers a taxpayer some opportunity to control the timing of engagement with ATO case officers. The ATO understands that this can afford both taxpayers and the ATO with opportunities to reach common ground and to resolve tax disputes sooner. That is in everybody’s interests. Even where little progress is made in an IHF due to the nature of dispute, objection and appeal rights are preserved and the IHF process can still be of strategic value to a taxpayer on the long haul to resolving a protracted tax dispute with the ATO.