Impending change to the individual Australian income tax residence rules

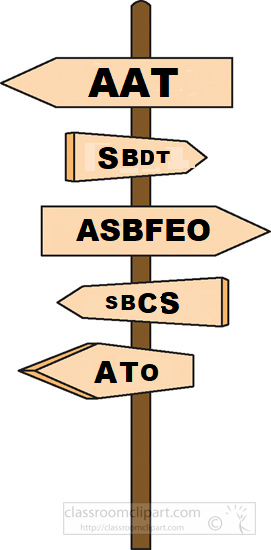

A measure in the Federal Budget 2021–22 is to replace the current individual tax residence rules with residency tripwires for an individuals who are tax resident where an individual is any one of:

- ordinarily resident in Australia (resides test) – based on legal case precedent;

- has an Australian domicile (domicile test) – which can activate unless the Commissioner of Taxation (Commissioner) is satisfied the permanent place of abode of the individual is outside of Australia;

- present in Australia for more than a half of the year of income (183 day test) – which can activate unless the habitual place of abode of the individual is outside of Australia and the Commissioner is satisfied that the individual does not intend to take up residence in Australia ; or

- a member of certain government superannuation funds;

in a year of income with an “improved and simplified” individual tax residence test based on:

- a bright-line test derived from the 183 day test under which an individual who is physically present in Australia for more than 183 days are taken to be resident; and

- the prospect of still being a resident nonetheless “in more complex cases” where the individual is physically present in Australia for less than 183 days such as where an individual is physically present for 45 days or more and has two or more of these other attributes/triggers of Australian tax residence:

- a right to reside permanently in Australia;

- Australian accommodation;

- Australian family; and

- Australian economic interests.

(45 day triggers) based on recommendations of the Board of Taxation. The reform of the individual tax residence rules is justified in the announcement on the grounds that the current rules are difficult to apply, create uncertainty and result in high compliance costs, including need to seek “third-party” aka professional advice, despite individuals having otherwise simple tax affairs.

Sanderson v. Commissioner of Taxation

The recent case of Sanderson v. Commissioner of Taxation [2021] AATA 4305 is an instance of an individual unsuccessfully running his tax residence appeal under the current rules without professional representation. Mr. Sanderson may or may not have had simple tax affairs but, in any case, the Administrative Appeals Tribunal decision reveals he had an income of $494,668 in the 2016 income year in dispute which suggests professional advice and representation might have been accessible to help him resist the adverse outcomes of his tax appeal.

Self-representation – the statistical ugliness

Self-represented taxpayers can run their own tax appeal and, in the Tribunal at least, rules of evidence and other procedural requirements are relaxed so that a person without legal training can so present their case.

In most tax appeals against income tax assessments, brought to either the Tribunal or the Federal Court, the Commissioner succeeds where the appeals progress to full hearing and decision. When the statistics concerning cases where appellants who are professionally represented and appellants who are self-represented are compared the proportion of Commissioner wins becomes even more lop-sided. As someone involved as a representative in, and who follows, these cases I can conclude that tax appeals, where self-represented taxpayers take the Commissioner on and succeed, are rare and reflect that self-represented taxpayers:

- struggle to comprehend complex tax laws, understand them in context or appreciate how to present contentions about their case in a contested environment; and

- do not appreciate how facts relevant to their case need to be presented so those facts are accepted or likely accepted as evidence.

Inadequate evidence

As the Budget measures and Board of Taxation suggest, the current individual tax residence rules have amplified challenges for a self-represented appellant to the Tribunal in a tax residence case that made likelihood of success for Mr. Sanderson even more remote. As I have noted in this blog in many places (see the Onus tag) the burden of proof of facts in tax appeals is with the taxpayer but there is more that can go wrong with evidence in tax appeal cases than that. In Sanderson Senior Member Olding of the Tribunal made these findings about the evidence concerning the taxpayer in the case:

29. One is the manner in which Mr Sanderson completed incoming passenger cards when he returned to Australia. He declared that he was a ‘Resident returning to Australia’ and on various cards indicated an intention to stay in Australia for the next 12 months. Mr Sanderson’s response to cross-examination about the passenger cards – ‘I guess I lied on the form’[18] – does not help his credibility, but is probably correct in respect of the latter question since his stays were for less than 12 months.

[18] Transcript of proceedings, P-46, ln 27.

30. Another is a loan application form completed by Mr Sanderson in March 2011. The Benowa property was listed as Mr Sanderson’s residential address with the status box ‘Own home’ selected and the property described as ‘live in’. Again, Mr Sanderson’s response to questioning – ‘Maybe I lied to get the loan I don’t know. I don’t recall.’[19] – was unhelpful. What is clear is that either the statement was not accurate or Mr Sanderson’s evidence that he did not intend to live in the home at the time was not truthful; both statements cannot be correct.

Sanderson v. Commissioner of Taxation [2021] AATA 4305 at paragraphs 29-30

As Senior Member Olding observes, propensity to lie revealed in evidence in a tax appeal depletes credibility of a taxpayer which is generally decisive in a case against the Commissioner whose officers and witnesses are usually thoroughly credible. So the Commissioner’s witnesses will be believed and the taxpayer won’t be believed about contested questions of fact with near inevitable consequences.

Self-serving evidence

Self-represented taxpayers often over-estimate how persuasive their own statements of fact and intent will be in a tax appeal forum. In Sanderson Senior Member Olding reminds us that a taxpayer’s self-serving evidence needs to be approached with caution:

Has Mr Sanderson proved the amounts transferred to his account were repayments of loans?

38. In approaching this issue, I am mindful of two judicial warnings. One is that self-serving evidence of taxpayers should be approach (sic.) with caution. The other is that nevertheless a taxpayer’s evidence should not be regarded as prima facie unacceptable unless corroborated.[24]

[24] Imperial Bottleshops Pty Ltd v Commissioner of Taxation (1991) 22 ATR 148, 155; and generally: Federal Commissioner of Taxation v Cassaniti [2018] FCAFC 212.

Sanderson v. Commissioner of Taxation [2021] AATA 4305 at paragraph 38

The resides test and the weight of facts

So the evidence in Sanderson accepted by the Tribunal diverged from how the taxpayer tried to present it. It transpired that Mr. Sanderson, who had spent 83 days in Australia in the 2016 income year, and was claiming not to be a tax resident of Australia was found by the Tribunal to have:

- had a home in Benowa on the Gold Coast with his family;

- business interests in Australia;

- returned to Australia in the 2016 income year for business purposes where the Sanderson Group maintained a serviced office;

- held directorships in Australian companies which he had had for some 30 years by 2016;

- had access, with his wife, to a company car in Australia which he regarded as his own vehicle;

- been treated by medical professionals in Australia with whom he had longstanding relationships; and

- maintained Medicare and medical insurance coverage in Australia, although he also had health insurance coverage elsewhere;

in that income year.

From those findings the Tribunal decided that the taxpayer was ordinarily resident in Australia (viz. satisfied the resides test) and, based on that decision, it was unnecessary, according to the Tribunal, for the Tribunal to consider the domicile test. Although the taxpayer was an Australian citizen, thus clearly with Australian domicile, the issue with the domicile test would have been whether the Commissioner should have been satisfied or not that the taxpayer had a permanent place of abode outside of Australia.

What might a professional representative have contributed?

A saving in time and resources may have been achieved if this case had been professionally evaluated at an early juncture. Evidence where the taxpayer eventually admitted to lying could have been considered to understand how detrimental it would be, how it would come across and whether it deprived the taxpayer of realistic prospect of success in the case.

Professional advice could have been taken about the exceptional nature of cases where taxpayers, whose immediate families were living in Australia, had successfully established that they were not tax residents of Australia. A notable instance of an exceptional case is Pike v. Commissioner of Taxation [2019] FCA 2185 which I considered in my December 2019 blog – Tax residence – is it administrable after Pike? https://wp.me/p6T4vg-gW. In Pike the taxpayer was accepted as a credible witness able to establish that he was residing in Thailand while his family lived in Australia at the times in dispute. Mr. Pike’s connections to Australia were comparatively more tenuous to Australia than Mr. Sanderson’s.

In the conduct of Sanderson, the self-represented taxpayer appears not to have raised or agitated the question of residence under the relevant double tax agreement (DTA) which was a key matter in Pike. Despite the long list of factors on which the Tribunal could find that Mr. Sanderson was ordinarily resident in Australia, a taxpayer can still assert that a “tie-breaker” provision in an applicable DTA, where the taxpayer is ordinarily resident in both places (a dual resident), applies to make the taxpayer not ordinarily resident in Australia by virtue of the DTA. Perhaps the taxpayer in Sanderson could have contended that he was a resident of Malaysia who had been lodging income tax returns in Malaysia and that he should have been treated as a resident of Malaysia under the Australia Malaysia DTA?

Or maybe these inferences shouldn’t be drawn from the Tribunal’s decision? We’ll never know, of course, because the taxpayer opted to self-represent.

And what would have happened under the reform had it been the individual tax residence regime?

The taxpayer in Sanderson would not have been a resident under the “bright-line” 183 day test having spent 83 days in Australia in the relevant income year. However, as the taxpayer spent more than 45 days in Australia and these 45 day triggers are enlivened as the taxpayer had:

- a right to reside permanently in Australia;

- Australian accommodation; and

- Australian economic interests,

two of the 45 day triggers are enough to cause the taxpayer to be hypothetically treated as a tax resident of Australia under the reform.

Some other thoughts on the 45 day triggers

This deceptively simple outcome expected in future under the reform is in tension with DTAs and international taxing norms where other countries will generally be looking to tax individuals, present in their country for up to around 320 days (365 – 45) in the country’s fiscal year, as tax resident in their country. Situations were individuals are taxed as resident in both Australia and other countries will abound as the reform, unlike the current rules, is not closely aligned to DTAs and international taxing norms when a 45 day benchmark for residence is used in “complex” cases where the 45 day triggers apply.

45 days is meagre especially in an era where travel plans of expatriate Australian citizens, who return to Australia for a visit planned as short, can be disrupted by border closures. Many such expatriates are eager to avoid, and the reform should be adjusted to prevent, structural impact to their tax affairs on being made Australian tax resident due to a visit which exceeds 45 days for reasons beyond his or her control.