An objection:

Be convincing

The grounds on which the taxpayer relies, i.e. the contentions and arguments, should be robust and conclusive to convince the commissioner to allow the objection. In most cases, contentions and arguments alone will not be convincing and the objection submission should show:

- the facts supporting the grounds; and

- the evidence which supports the facts.

Presentation of grounds, facts and evidence

How grounds, facts and evidence should be presented varies case by case. Where facts or evidence are open to dispute then they need to be presented in the objection in a considered and rigorous way.

We advocate systematic organisation of grounds, facts and evidence in cases where facts and evidence supporting grounds are voluminous or complex.

If facts and evidence are presented wrongly then the credibility of the taxpayer and the contentions are undermined. It is also possible that:

- the taxpayer may make unnecessary or unhelpful admissions;

- the commissioner will:

- draw adverse inferences;

- further investigate the facts; or

- impose a penalty tax for a false or misleading statement; or

- in the event of an appeal, the taxpayer and witnesses could be cross-examined about matters contained in the objection.

The not so helpful ATO objection forms

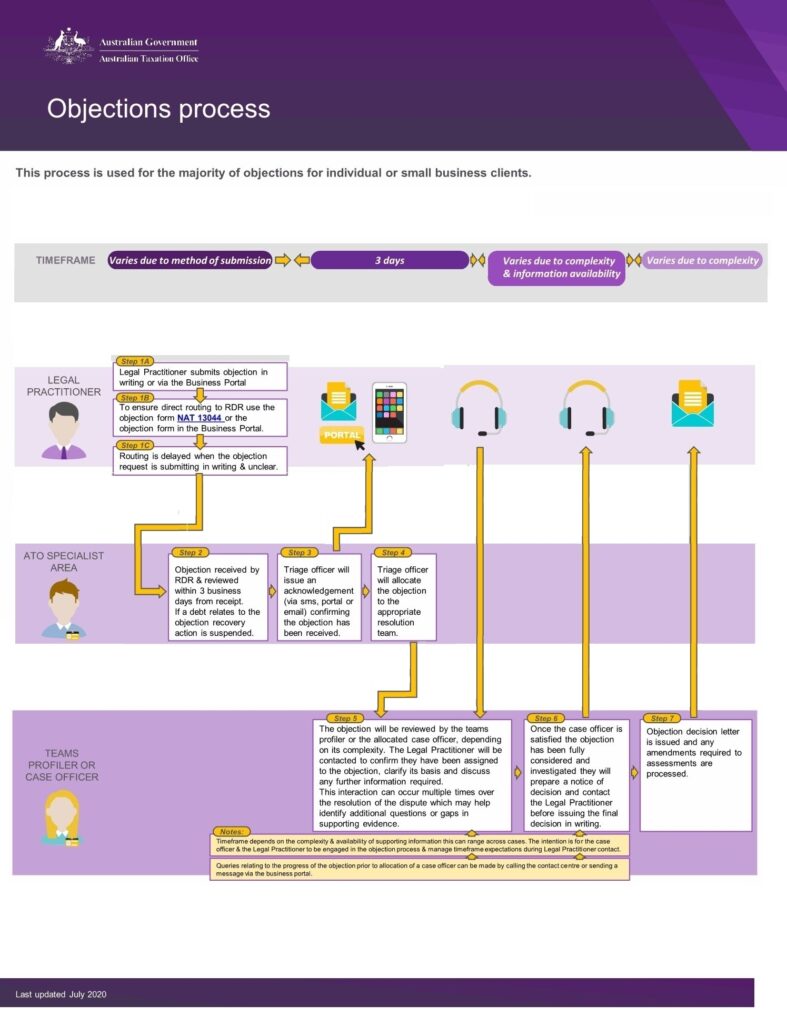

The Australian Taxation Office (“ATO”) has a generic and a “Professionals” version of its objection form to complete and send as paper or online. However:

a form of objection that does not mimic the ATO forms can be prepared for a taxpayer and submitted to the ATO in a number of ways including:

- using the tax agent portal – although a “correspondence” rather than an “objection” gateway must be used so that the objection is not corralled to the ATO form and style of objection;

- by post;

- by delivery of the objection in person to an ATO shopfront – this way can be useful if the taxpayer needs to ensure and prove submission within the time limit.