How might complex issue resolution by the ATO help?

A useful service for tax professionals

A new and useful service from the Australian Taxation Office (“ATO”) is Complex Issue Resolution (“CIR”). An escalation is offered for complex or multiple related tax technical issues and abnormal administrative issues which officers contacted through regular channels into the ATO, or who are acting in a regular ATO compliance role, would not usually be able to address.

The limitations of Complex Issue Resolution

CIR is accessible only by tax professionals including tax agents and legal practitioners.

Guidance from CIR is not binding on the Commissioner of Taxation. It is not a substitute for objecting against an assessment, seeking a private binding ruling or making a complaint about how the ATO is dealing with the taxpayer.

Value proposition

The inherent benefit of restricting CIR to tax professionals is twofold:

- the restriction is a filter to ensure that issues put by taxpayers to CIR are actually complex better targeting the CIR resource; and

- it is more likely that a tax professional can pinpoint and explain a complex issue/s. Careful and thorough explanation can be vital to the ATO correctly appreciating the complex issue and to how the ATO may ultimately deal with it. The Tax Objection is a tax professional and we understand how complex issues should be presented to the ATO.

Thus a taxpayer, through his or her tax professional, can drive recognition of complex tax technical issues and abnormal administrative issues including where an officer of the ATO may not grasp the issue and may not be willing to escalate the issue within the ATO to a more senior or experienced officer who is better equipped to deal with the issue. Equally CIR may be limited to where other escalation has not occurred within the ATO such as allocation of the issue to Interpretative Assistance (IA) or comparable ATO officers who decide objections and private ruling applications.

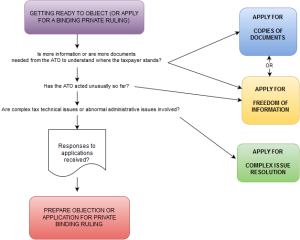

CIR in a tax dispute/objection strategy

In our post “I’m objecting – do I need freedom of information (FOI)?” we looked at the kinds of tax disputes where seeking freedom of information before, or concurrently while, objecting to a tax assessment is advantageous. It is all about understanding what the ATO position is, or is likely to be, before committing time, effort and resources to a tax objection and dispute.

Applying for CIR may have a number of advantages over applying for FOI in the process of readying to object against a tax assessment:

- it looks like obtaining CIR guidance will generally be quicker than obtaining FOI although this is not yet certain as CIR is so new. Where time is running out against the time limit to object to an assessment it may be invaluable to receive guidance from CIR before finalising a notice of objection; and

- applying for CIR may resolve the matter entirely. The escalation of a complex issue to a senior and experienced officer may lead to CIR guidance which puts a view either:

- which the taxpayer is inclined to accept for one reason or another; or

- which shows that the ATO has sufficiently adopted the view contended for by the tax professional in the application for CIR.

Either way the problem can be resolved before an objection or application for private ruling is completed saving costs and effort.

Although non-binding, CIR guidance is likely to firm either as the position, or as one of the positions, of the Commissioner on the complex issues on which the dispute turns. This gives a taxpayer objecting to an assessment who has CIR guidance the opportunity to make nimble inclusions in the notice of objection and to revise or abandon arguments to raise prospects of success in the dispute.

No comments yet.