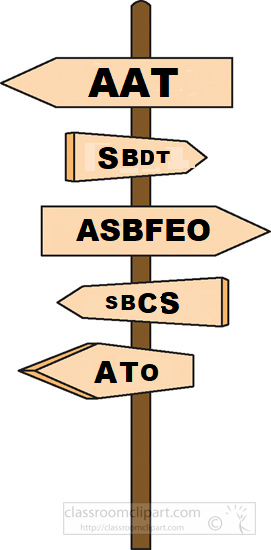

Determining the AAT fee on a tax appeal to the AAT

The applicable fees to appeal

Unless a taxpayer is disadvantaged and qualifies for a concessional $100 fee – see our blog post: Small business now has its own dedicated taxation division of the AAT at https://wp.me/p6T4vg-dx, fees for review of the Commissioner of Taxation’s decisions reviewable by the AAT are now:

- $952 for review by the Taxation & Commercial Division; and

- $511 for for review by the Small Business Taxation Division (SBTD).

These fees have gone up since our blog post in March 2019.

Who can appeal to the SBDT?

As explained in our earlier blog post, appeal to the SBTD is available where the appellant is a small business entity under section 328-110 of the Income Tax Assessment Act (ITAA) (C’th) 1997. A small business entity is an entity (see section 960-100 of the ITAA 1997) carrying on business with an aggregated turnover of less than $10 million in an income year.

Multiple decisions – single fee on an applicant

Where the appeal is against more than one decision that relates to the appellant, the AAT can allow appeals to be dealt with together so only one fee applies. For instance, if a taxpayer is appealing against decisions to disallow a series of objections against multiple assessments of tax across multiple tax periods then the AAT can apply a single fee.

The AAT also allows for a single fee to be imposed on an “organisation” rather than separately on each of the members of the organisation applying to appeal.

Partnership CGT SBDT appeal

We have a client seeking review of objections against multiple assessments of income tax in the SBTD. The client is a partnership under State law (viz. a general law partnership carrying on business) and is a section 328-110 small business entity eligible to appeal to the SBTD.

The appeal concerns decisions by the Commissioner to disallow objections by the partners against income tax assessments seeking reduction in amounts included as assessable net capital gains to the partners in a series of income years.

Net capital gains made on partnership assets are assessed as income to the partners individually in a partnership. That is capital gains on partnership assets are not included in partnership income nor are they included in a partnership’s income tax return.

Soon after the introduction of capital gains tax (CGT) in September 1985 to include capital gains in assessable income it became apparent that it was impractical to assess partnership capital gains as partnership income to partnerships. Not only is a partnership not a legal owner of partnership property, and thus not apparent as the entity against which to assess a gain on a CGT asset, partnership property is often not owned by partners in the same names or proportions as partners share in the income and losses of the partnership.

Should a single fee have applied to the partnership?

The treatment of a partnership as an entity for some purposes, but not for others, can be confusing. It is via the small business entity regime that our client, a partnership, qualifies as a small business entity and this also impacts how the capital gains on partnership assets in dispute are assessed to the partners. The partnership is an “organisation”. Should a single fee apply to appeals by all of the partners of the partnership relating to the partnership asset CGT issues which are in common to all of the partners?

For the moment the AAT Registry say no. The AAT Registry has sought the $511 fee from each of the partners and has raised the appeals as separate cases (at odds with how the Australian Taxation Office dealt with binding private ruling applications and objections from the client in substance). The AAT Registry have raised the prospect that partners can seek to have their cases combined into one case and can seek a refund of the further instances of the $511 fee at a later point in the proceedings.

If the client is successful in obtaining a refund of the additional $511 fees we will update this story with a comment below.

No comments yet.