Etmekdjian – the disqualified are out of the SMSF system

In an Administrative Appeals Tribunal decision this month in Etmekdjian v. Commissioner of Taxation [2020] AATA 3821 (1 October 2020), the AAT refused to extend a waiver of disqualification to the applicant so the applicant could manage his own self managed superannuation fund (SMSF). The applicant had been disqualified under Part 15 of the Superannuation Industry (Supervision) Act 1993 (SIS Act).

Automatic disqualification and its waiver

There are a thin 14 days following disqualification to apply for a waiver of the disqualification once a person is disqualified: section 126B. In this case the applicant had been disqualified automatically under sub-section 120(3) of the SIS Act on conviction, by a NSW Local Court, for Commonwealth Criminal Code offences. The offences were for dishonestly backdating employee share scheme elections under former section 139E of the Income Tax Assessment Act 1936.

The applicant was outside of the 14 days allowed to seek the waiver so the applicant sought an extension of time to do so from the AAT.

AAT decision

The AAT refused:

- to accept that the applicant’s unsuccessful appeal to the District Court against the conviction stayed the conviction by the Local Court and thus the date of automatic disqualification for section 120 purposes; and

- to allow the extension of time as there was an absence of exceptional circumstances explaining the failure to lodge the application for waiver against disqualification within 14 days.

Context of the AAT decision and Part 15 disqualifications

Deputy President Bernard McCabe observed at the outset in paragraph 1 of the AAT decision:

Managing a superannuation fund – even a small, self-managed fund – is a big responsibility. There is a public interest in managing these funds properly given the tax advantages they enjoy. To that end, the Superannuation Industry (Supervision) Act 1993 (Cth) (SISA) establishes rules designed to ensure prudent management. Part 15 of SISA includes rules regarding disqualified persons. A disqualified person may not be a trustee, investment manager or custodian of a superannuation entity, or be a responsible officer (such as a director) of a corporation that performs those roles: s 126K. A person can be disqualified by the Commissioner of Taxation (where the Commissioner is the regulator) or the Federal Court (where the Australian Prudential Regulatory Authority is the regulator) on a variety of grounds, but a person will be automatically disqualified in circumstances set out in s 120. .…

[2020] AATA 3821 at paragraph 1

The AAT found that it only had power to extend the 14 day period strictly when exceptional circumstances warranted that extension. Deputy President McCabe concluded:

….The law requires that I identify exceptional circumstances that prevented the applicant from complying with the 14 day time limit. It is not enough to establish the applicant had a good excuse, or that non-compliance does not result in any harm, or that the applicant has a good case in relation to the substantive issue. This is not a standard ‘extension of time’ case.

21. The applicant has failed to identify any ‘exceptional circumstances’ that prevented him from making the application within the time frame contemplated in s 126B(3). In those circumstances, the decision under review must be affirmed.

[2020] AATA 3821 at paragraphs 20 and 21

The AAT’s strict approach is no surprise when it comes to the disqualification rules in Part 15. Part 15 reflects a low tolerance approach in the SIS Act to persons designated unfit to manage a superannuation fund.

Difficulties – SMSFs with a disqualified trustee/director/member

The author has seen Part 15 disqualifications happen on bankruptcy by operation of sub-section 120(1) of the SIS Act.

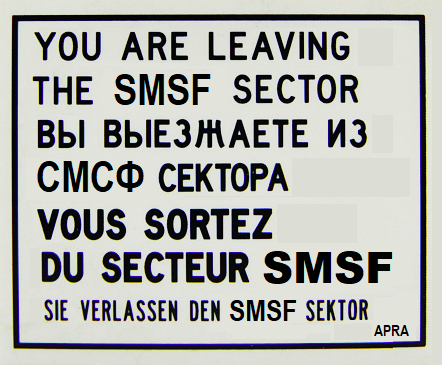

A person disqualified on bankruptcy, or any other disqualified person such as Mr. Etmekdjian, can’t be a trustee, a director of the trustee or a member of a SMSF. A fund with a disqualified participant falls off the register of superannuation funds as a SMSF regulated by the Commissioner of Taxation. The fund becomes (at least notionally) regulated by the Australian Prudential Regulatory Authority (APRA) instead.

So the Australian Taxation Office won’t and can’t assist once the fund is no longer a SMSF.

Unless a deactivated SMSF, on a participant becoming Part 15 disqualified, can nimbly:

- convert to an APRA regulated fund; and

- appoint an approved trustee;

based on a power in the trust deed of the fund to do so, or disqualified persons promptly vacate the fund to prevent deactivation, the fund reverts to an administrative no man’s land. Even arranging a roll out of benefits to another fund is fraught following deactivation. The fund won’t be practically manageable or administrable.

Time for a SMSF deed upgrade?

Lack of capability in a SMSF trust deed to convert a SMSF to an APRA fund is one of a number of indicators that SMSF trust deed may need of an upgrade to comply with today’s SIS Act requirements.

No comments yet.