GST withholding on residential property sales to plug a phoenix hole

The Federal Government, through the Phoenix Task Force involving the Australian Taxation Office (ATO) and other government agencies, has been cracking down on invidious “phoenix” activity through this decade.

The phoenix swindle

The idea behind a phoenix entity is that the entity, usually a company, is set up to undertake and undertakes a money-making activity where a considerable portion of the money made is owed to government, usually as taxes such as PAYG withholding or GST, perhaps after a significant claim of GST input tax credits, or to other agencies or creditors. Before the taxes, or money owed, can be collected, the money made by the entity is stripped from the entity by the controllers of the entity. The controllers can then rise from the ashes, phoenix like, with a new entity which can again make money for the controllers in the same way and can again be stripped of money owed to government, agencies and creditors by them.

Proposed GST withholding by purchasers of residential land

The government is addressing a phoenix trouble spot with property developers by the proposed introduction of a GST withholding from 1 July 2018 under which purchasers must retain one eleventh of the price of the property on or before settlement of sale of residential land for remission to the ATO. The Exposure Draft: Treasury Laws Amendment (2017 Measures No. 9) Bill 2017 has now been released in line with an announcement in the 2017/18 Budget. The withholding requirement in the Exposure Draft Bill would be a short circuit to the usual GST regime which obliges a vendor who is registered or required to be registered for the GST to collect GST on a taxable supply to a purchaser and for the vendor to pay it to the ATO via their BAS.

GST withheld 10% – GST owing less?

If the vendor applies the margin scheme then the purchaser will have withheld too much GST. The withholding rules in the Exposure Draft Bill include a mechanism which allow a vendor, who is not a monthly BAS lodger, to seek an early refund of the overpaid GST when too much GST has been withheld for the vendor by the purchaser.

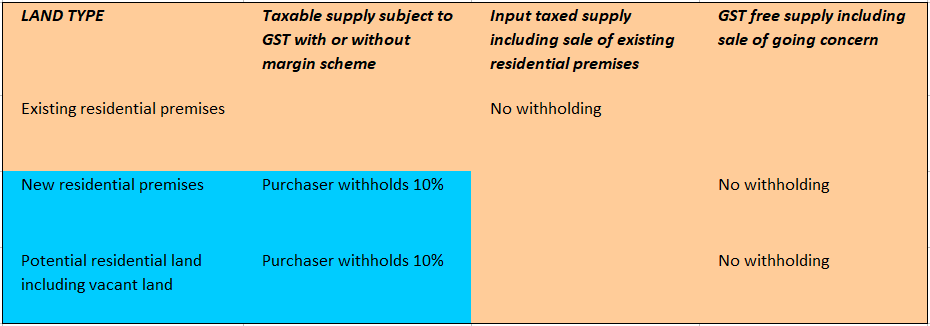

GST withholding will apply to a taxable supply of land by a vendor who is registered or required to be registered for the GST under the Exposure Draft Bill. Both new residential premises and land that is potentially residential land, though not if it is input taxed as existing residential premises, require GST withholding by the purchaser. In other words the withholding obligation is broadly imposed so that the purchaser does not need to inquire about whether the land is new residential premises for GST purposes to the vendor. Broadly, and subject to exceptions, it is understood that the withholding obligation arises on the purchase of land from a vendor who is registered or required to be registered for the GST as follows:

Purchaser might need to withhold 22.5% for the ATO!

The proposed introduction of the GST withholding regime follows two years after the introduction of the non-resident capital gains tax withholding tax which requires a purchaser to withhold 12.5% of the price unless the vendor produces a ATO clearance certificate to verify that the vendor is not a non-resident: see Australia is now tracking & surcharging foreign buyers of land. These withholding obligations will require focus in conveyancing with enterprises which sell residential or potential residential land in the course of their operations.

Both measures visit responsibility to collect tax on the purchaser because of the some time difficulty of collecting tax from a vendor who departs with the sale money leaving taxes and creditors owed. Potentially both withholding obligations can apply to a purchaser who would then be withholding 22.5% of the price to pay to the ATO. There is no clearance certificate or other relief to relieve a purchaser from GST withholding, as yet, which may mean that one-eleventh GST withholding will have a broad application to buyers of residential land from GST registered property developers and traders should the Exposure Draft Bill become law.

In an effort to combat a perceived non-compliance with GST law from the property development industry the Federal Government has now released the Treasury Laws Amendment (2017 Measures No. 9) Bill 2017. This law comes into effect from July 1st 2018.