Perils lodging a really late objection against a tax assessment

As mentioned in an earlier post – Is there a time limit for putting in a tax objection?

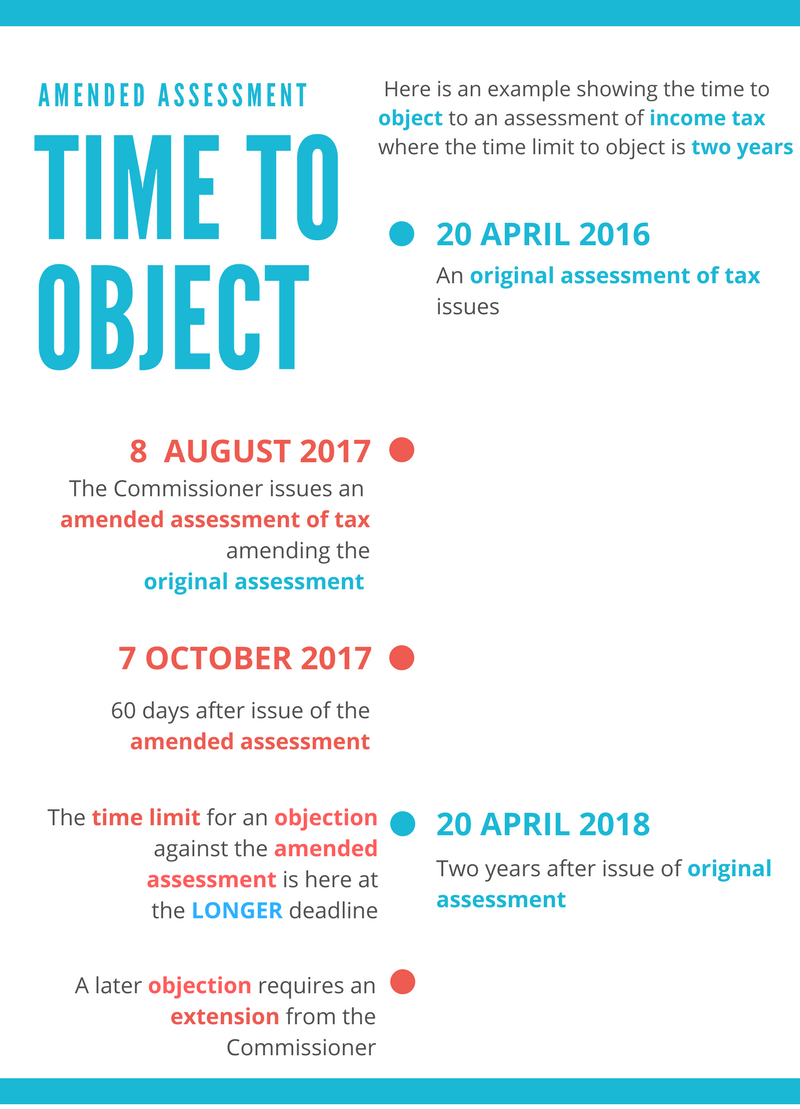

time limits for lodging objections have been based on sixty days but, for most of the significant federal taxes such as income tax, goods and services tax and fringe benefits tax, among others, extended four year and two year limits apply based on the issue of original assessments. Limits for amended assessments are based on the longer of:

- sixty days from the issue of the amended assessment; and

- the remaining limit on the original assessment.

Link between limits on time to object and on time to amend assessments

The extended four year and two year limits on lodging objections for these taxes are congruous with limits on the amendment of assessments which restrain both the Commissioner and the taxpayer.

Limit on time to amend an assessment doesn’t apply to an amendment following an objection

The taxpayer has a rare advantage over the Commissioner in the context of income tax because section 170 of the Income Tax Assessment Act (ITAA) 1936 provides an exception from these limits on the amendment of assessments for an amendment at any time as a result of an objection made by the taxpayer or pending a review or appeal.

Usually the Commissioner must assert fraud or evasion, or obtain the consent of the taxpayer prior to expiry of the limit, to extend the limit for the amendment of assessments under section 170.

Extension of time when outside limit on time to object

To take that rare advantage that taxpayer must be allowed to object either by right within the time to object or with an extension of time to object after that. If a taxpayer does not lodge an objection within the designated time under section 14ZW of the Taxation Administration Act 1953, then the taxpayer must seek the extension of time from the Commissioner under section 14ZX.

When will the Commissioner give an extension of time to object?

Generally speaking, the Commissioner is systematically open to granting an extension of time to object however the taxpayer must apply for a section 14ZX extension giving a plausible and acceptable explanation of the reasons and circumstances why the objection is to be lodged late.

In deciding whether to give an extension of time to object the Commissioner will preliminarily consider the merits of the case made out in the objection and whether there may be prejudice to the Commissioner, or to the taxpayer, including due to reliance on views of the professional advisors of the taxpayer, or of the Commissioner, by the taxpayer belatedly found to be incorrect.

Big dollars involved in really late objections

The recent case of Primary Health Care Limited v. Commissioner of Taxation [2017] AATA 393 involved an appeal by an ASX-listed company against a decision of the Commissioner to refuse extensions of time to the company to lodge out of time objections against its income tax assessments. The case is notable because it involved:

- total net reduction in taxable income of the taxpayer over five years of income of $155,459,566 at stake in the refused objections; and

- extensions of time sought on 23 June 2015 for objections dealing with assessments for five years of income being the years ending 30 June 2003 to 30 June 2007 inclusive. That is, the extensions were sought for objections which were up to seven years late on the time limits to object.

Following an earlier successful tax appeal by the company in relation to the 2010 income year, it had become apparent that significant business activities of the company group, who operated many medical centres, were on income account and not on capital account and so the company group was entitled to significant deductions under section 8-1 of the ITAA 1997 contrary to advice and understandings in earlier tax opinions received by the company from counsel. Importantly the Commissioner had held and communicated corresponding views about the availability of the deductions to the company. In the 2010 case these views proved to be incorrect.

Long delay explainable and no prejudice

The Administrative Appeals Tribunal (AAT) identified that the company had been misled by these incorrect stances, which explained the long delay in lodging the objections, and that the Commissioner suffered no prejudice due to the delay in lodging the objections. The AAT thus found for the company and allowed the extensions of time to the company to lodge its objections.

The long delay of the company beyond the designated time limits for lodging these objections raised the possibility of prejudice to the Commissioner and the tax system should the company be allowed to contest its case in those long past years of income. The sheer length of the delay contributed to the decision of the Commissioner to refuse the extensions of time.

It was only because:

- the company was able to fully explain its delay, as the company justifiably understood that it had no case on which to object based on the law as it then stood, which was a misunderstanding to which the Commissioner had contributed; and

- because prejudice to the Commissioner from allowing the extensions of time to the company could not be identified;

that the AAT found in the favour of the company.

The Full Federal Court has upheld the AAT decision that extension of time to lodge objections should be granted to Primary Health Care Limited

Commissioner of Taxation v Primary Health Care Limited [2017] FCAFC 131

INCOME TAX – objections to notices of assessment – application for extension of time for lodging objections – relevant matters for exercise of discretion – whether prejudice suffered by Applicant if objections lodged outside of time – whether explanation for delay can ever be positive factor towards exercise of discretion ADMINISTRATIVE LAW – whether failure to take into account relevant consideration – whether decision irrational – whether improper exercise of discretionary power in s 14ZX(1) of Taxation Administration Act 1953 (Cth)

KENNY, PERRAM & ROBERTSON JJ – 24 AUGUST 2017