SMSFs getting practical to invest in land with others

The force of the superannuation law is that investment in land by a SMSF needs to be prudent. An investment needs to be considered in a business-like way.

Limited recourse borrowing is one way to fund investment in real estate. SMSF principals may prefer to arrange equity investment from private connections outside of the SMSF.

Investment as a tenant-in-common?

I am frequently asked about SMSFs participating in land investments as a tenant-in-common with related and unrelated entities of the principals of the SMSF. It is apparent from the NTLG Superannuation sub-committee technical minutes of June 2011, released by the Australian Taxation Office, that tenants in common arrangements for SMSFs are not going to be prudent for the SMSF without careful and restrictive implementation. Wherever other tenants in common could borrow, or use or risk their interest as security, the SMSF tenant-in-common is exposed to uncontrolled risks which would bring into question, for instance, whether the SMSF:

1. has acted prudently pursuing the investment for members for whom it is bound to provide;

2. has breached regulations which prevent charges, or the potential for them, being taken over SMSF property; or

3. has satisfied the sole purpose test.

Investment through a trust?

The tenant-in-common option is frequently turned to because of the restrictive regime that has applied in relation to the investment by SMSFs in related trusts since 1999. Shortly stated, a post 1999 investment by a SMSF in a trust, which is related to the principals of the SMSF, a “related trust”, is treated as an “in-house asset” and more than 5% of the assets of a SMSF in in-house assets can leave the SMSF non-complying.

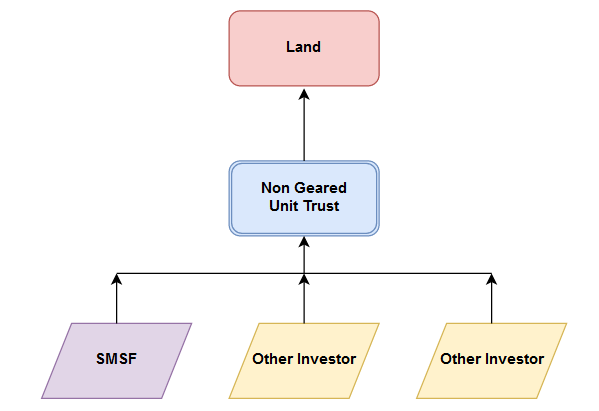

Non-geared unit trust – expressly relieved from being a related trust

The SIS Regulations provide an express exception. A superannuation fund can invest in a non-geared unit trust (NGUT) to which Regulation 13.22C applies without the NGUT being taken to be a “related trust” and thus the investment isn’t taken to be an investment in an “in-house asset”.

This express exception is especially limited and, aside from relief from “related trust” treatment causing in-house asset difficulty, offers no expansion in the kind of investment that can be pursued with superannuation money. In other words, the investment still needs to address 1 to 3 above, for instance.

The Regulation 13.22C and 13.22D requirements and restrictions on NGUTs essentially mirror the restrictions on regulated superannuation funds. NGUTs cannot borrow and they can only “lend” to operate a bank account. They cannot secure or charge their assets. (A non-SMSF unit holder in a NGUT could give a security over his, her or its units but security could not be given over the assets of the NGUT.) A NGUT cannot run a business – unlike with superannuation funds, this is a direct requirement. Loss of NGUT status, so that the NGUT becomes a related trust triggering in-house asset difficulties follows the merest breach under Regulation 13.22D which can put complying status of a SMSF investor at the mercy of the ATO.

Practicalities

1. Nevertheless a carefully implemented NGUT can be the most practical way to pursue unitised investment in land by related parties and unrelated parties of a SMSF with the SMSF.

2. Compliance with the regulations needs to be closely monitored as stated. Any debtor or creditor, aside from a bank for the (credit only) trust bank account, potentially causes loss of protection from related trust status. Funding of, and money flow to and from, the NGUT without breaching the rules is thus practically challenging. The trustee needs to raise equity (unit) funding whenever any extra funding is required. From a practical and paperwork burden perspective, using partly-paid units is a strategy that might be considered wherever the trust needs a flexible equity facility.

3. The activity of the NGUT that invests in land also needs to be monitored and carefully planned and structured. It is possible for real estate activity by trustees to be considered the carrying on of a business under tax rules. As stated a NGUT cannot carry on a business under the NGUT regulations nor, if it has a trust deed to suit, under its trust deed.

4. Under the special trust rules in NSW, a special trust pays land tax at the highest land tax rate without a threshold. A SMSF can attract a better land tax rate. A NGUT will not automatically qualify for the rate for a SMSF to the extent a SMSF invests in it. However if the NGUT is a “fixed trust” under the land tax rules then a better rate than the special trust rate can be achieved. Hence there can be advantage to structuring a NGUT with a trust deed so that the NGUT can be treated as a fixed trust under the land tax rules.

5. A carefully crafted trust deed can be very useful to assist the trustees of a SMSF and a NGUT to keep within the express requirements and restrictions on NGUTs.

No comments yet.