Turning missing demographics into tax revenue

Hats off to Australian governments who have turned an imperative into a revenue opportunity. The Australian federal government regulator, the Foreign Investment Review Board (the FIRB), has not been well placed to track foreign purchases of real estate to date. The FIRB has been reliant on disclosure, and if prospective foreign buyers didn’t voluntarily disclose their planned land acquisitions, the FIRB has been none the wiser. There has been no register of (foreign) beneficial ownership of buyer entities which the FIRB can go and check even in the case of foreign real estate acquisitions completely prohibited under the foreign acquisitions law: the Foreign Acquisitions and Takeovers Act (C’th) 1975.

That has all changed. Buyers now need to demonstrate that they are not foreign to avoid hiked stamp duty in New South Wales, Victoria and Queensland. Foreigners who buy and sell Australian real estate are now under great scrutiny at both the buyer and seller ends of the land sale especially if the sale is for more than $750,000.

Big city real estate markets are buoyant, prices are high and foreign buyers are not exactly welcome by those looking to buy the same city real estate. The community has been surprised to learn that foreign purchases of Australian land have not been closely monitored. So, politically, it has been an opportune time to introduce these changes. Time will tell if they will be successful. They may well be. They will be a boon to the FIRB, but Australian buyers too will get caught up in the ramp up of imposts on foreign buyers. Why?

Buyers of Australian land

This is the bit for the FIRB. The New South Wales, Victorian and Queensland governments have just introduced hefty stamp duty and land tax surcharges on foreigners. From 21 June, 2016 a sworn Purchaser Declaration (“PD”) is now required from buyers, whether foreign or not, buying real estate in New South Wales. The PD is required along with stamp duty at the band the PD establishes that the buyer should pay to complete the conveyancing of a land sale. If the buyer of land in New South Wales is a foreign person (entity):

- a 8% SURCHARGE (for the 2018 tax year, it was 4% for the 2017 tax year) on the stamp duty (i.e. extra) applies (it’s a 7% surcharge in Victoria);

- the buyer is not entitled to the 12 month deferral for the payment of stamp duty for off-the-plan purchases of residential property; and

- the buyer faces 2% SURCHARGE (for the 2018 tax year, it was 0.75% for the 2017 tax year) on land tax (i.e. extra).

It’s plain on the PD that the information is going to the ATO – it asks for the FIRB application number for the purchase. This will let the Australian Taxation Office (“ATO”) and the FIRB gather comprehensive data on foreign land acquisitions. Coupled with significantly increased penalties for breach of the foreign acquisitions rules, the availability of this information to the ATO and to the FIRB will give the federal government real capability to penalise unlawful real property acquisitions by foreigners.

Where an Australian buyer will be caught out too – example of a buyer that is an Australian-based family discretionary trust

It is notable that the PD doesn’t seek the confidential tax file number (understandable as the ATO can’t get the States to collect those) or the Australian Business Number (if any) of a buyer trust. It relies on the name of the buyer trust and a copy of the trust deed of the buyer trust with all amendments must be included with the PD.

If a foreign individual, company or trust is a potential beneficiary of the usual style of Australian family discretionary trust that is a New South Wales land buyer then, usually, the trustee can distribute 20% or more (Victoria – more than 50%) of the income and capital to that foreign person. That gives the foreign person a “significant interest” in the trust enough to cause the trust to be a foreign trust under these rules to whom the foreign stamp duty and land tax surcharges apply.

So if the copy trust deed supplied with the PD indicates that a remoter family member, who is not an Australian citizen or an Australian permanent resident, but is a foreigner who is a potential beneficiary of an (otherwise) Australian family discretionary trust ABLE to receive 20% of income or capital (more than 50% in Victoria), even if that remoter family member/foreigner may not have:

- any current or past entitlement to income or capital of the trust; nor

- any strong likelihood of participating in income or capital of the trust;

his or her eligibility under the trust deed exposes the trust to foreign trust/person status and liability for the stamp duty and land tax surcharges under these rules accordingly.

Sellers of Australian land

The ATO has had a problem collecting capital gains tax from sellers who are offshore after the sale of Australian land. Under tax treaties worldwide rights to tax interests in land are almost universally reserved to the governments where the land is. As other forms of assets and activity are moveable and relocatable taxation based on place is not so reserved because it is less effective than taxation based on residence and/or makes less sense.

So, frequently, when a non-resident sells land and makes a capital gain taxable in Australia, the ATO has no interaction with the non-resident, aside from due to their Australian landholding. This has often left the ATO with little leverage to assist them to collect tax debts arising from CGT on disposals of Australian land by non-residents ceasing investment in land in Australia.

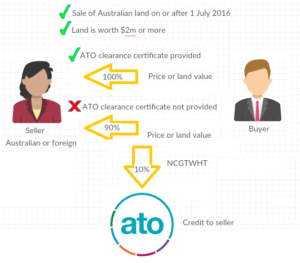

The solution is the tried and trusted withholding tax model. From 1 July, 2016, the non-resident capital gains tax withholding tax (“NCGTWHT”) is an obligation on the buyer (statistically likely to be a resident) to pay a non-final withholding tax to cover capital gains tax (likely to be) owing by the non-resident seller.

The NCGTWHT broadly applies as a non-final tax on sales of land worth more than $750,000 (from 1 July 2017, was $2m from 1 July 2016 to 30 June 2017). If the buyer does not receive an ATO clearance certificate from the seller then the buyer must withhold 12.5% (from 1 July 2017, was 10% from 1 July 2016 to 30 June 2017) of the value of the property (so 12.5% of the price for the land if it is an arms length sale, 12.5% of the “first element of the cost base” of the land to the acquirer if a CGT market value substitution rule applies in a non-arms length transaction).

Where an Australian seller will be caught out too – a non-final 12.5% tax

It is of no consequence that the seller is, or might be, an Australian resident/tax resident and the buyer is assured of this. There is no “reason to believe the seller is an Australian resident” exception for sales of freehold interests in land. Even the seller could be wrong – tax residence can a vexed question which is frequently litigated in tax cases.

The liability to the ATO is on the buyer unless the seller can obtain and provide a clearance certificate from the ATO to the buyer no later than settlement of the land sale so, if the seller does not return and pay the CGT on the seller for the sale, the NCGTWHT paid by the buyer on the seller’s behalf won’t be refunded.

Template contracts for the sale of land across Australia have been hastily adjusted to include conditions confirming that, where the land is worth more than $750,000:

- the buyer can contractually withhold the NCGTWHT from the price if the clearance certificate is not provided; and

- the seller can be assured that the NCGTWHT will be paid immediately by the buyer to the ATO to the credit of the seller.