To give effect to a bi-partisan initiative, changes aimed at making it easier, cheaper and quicker for small businesses to appeal to the Administrative Appeals Tribunal (AAT) against decisions by the Australian Taxation Office (ATO) commenced on 1 March 2019. Small business taxpayers contemplating a tax appeal to the AAT with scant legal knowledge or representation will benefit most from the changes. Represented small business taxpayers too can benefit from the easier, cheaper and quicker AAT tax appeals and may improve their prospects of obtaining funding by the ATO of legal representation costs of their appeal.

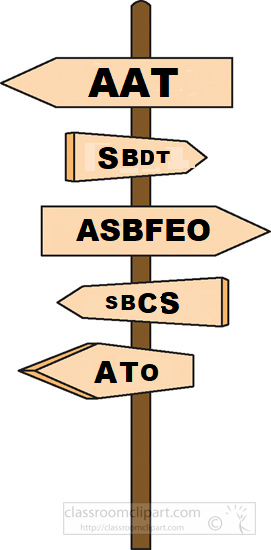

Under the changes small business taxpayers can appeal adverse tax objection decisions to the new Small Business Taxation Division (SBTD) of the AAT. The Small Business Concierge Service (SBCS) within the office of the Australian Small Business and Family Enterprise Ombudsman (ASBFEO) also commenced on 1 March 2019 to assist small business taxpayers with appeals to the SBTD.

Tax and related review by the AAT

The AAT can review decisions on objections against tax assessments and other specified decisions made by the Australian Taxation Office (ATO) in the ATO domain on appeal under the Taxation Administration Act (C’th) 1953 viz decisions on:

- Commonwealth taxes: income tax, goods and services tax, excise, fringe benefits tax, luxury car tax, resource rent taxes (petroleum and minerals) and wine equalisation tax;

- Australian Business Numbers, fuel schemes, fuel tax credits, the ATO’s superannuation administration; and

- penalties and interest relating to a. and b.

The SBTD can review these decisions where the taxpayer/applicant is a small business entity under section 328-110 of the Income Tax Assessment Act (C’th) 1997. A small business entity is an entity carrying on business with an aggregated turnover of less than $10 million in the current income year.

Cheaper – fees for AAT review

The ordinary filing fee for review of (appeal against) a reviewable decision by the ATO in the Taxation & Commercial Division of the AAT is $920 as at 1 March 2019. A single fee can apply if there are related multiple decisions in relation to the same appellant. A concessional fee of $91 applies for disadvantaged appellants: https://is.gd/1s5Vtt

The ordinary filing fee for review by the SBTD is a reduced $500. AAT regulations apply so that a SBTD taxpayer/applicant who the AAT finds is not a small business entity must pay an uplift to the ordinary $920 fee and their appeal will transfer to the Taxation & Commercial Division of the AAT.

Easier – Small Business Concierge Service

The SBCS of the ASBFEO assists a small business taxpayer with the SBTD appeal process and with advice about the appeal or prospective appeal to the SBTD the small business taxpayer plans. Although the SBCS is within the office of the ASBFEO and does not itself give legal advice, the SBCS:

- offers a one hour consultation with an experienced small business tax lawyer to an unrepresented small business taxpayer prior to the appeal so the lawyer can review the facts pertaining to the ATO decision and provide advice on prospects of success of the appeal. In arranging a pre-appeal consultation the taxpayer needs to be aware of the 60 day time limit that generally applies for making appeals to the AAT on these decisions. A co-payment of $100 for the consultation is required from the small business taxpayer and the balance of the small business tax lawyer’s fee for the consultation is paid by ASBFEO;

- assigns an ASBFEO case manager (not to be confused with the AAT case manager who will manage the appeals for the AAT) to help the small business to compile the relevant documents to maximise the benefit of the one hour pre-appeal legal consultation;

- assists with the appeal to the SBTD if the small business chooses to go ahead with the appeal. The ASBFEO case manager assists with the applications and submissions to the SBTD and with engagement by the small business taxpayer with the AAT process; and

- offers a second one hour consultation with an experienced small business tax lawyer to an unrepresented small business taxpayer after the appeal commences with the cost of the second consultation met by the ASBFEO without a co-payment.

Even if an unrepresented small business taxpayer utilises both hours of consultation with the assistance of the ASBFEO case manager it is still cheaper for the small business taxpayer to commence their appeal to the AAT for $600 in the SBTD, including the $100 co-payment, than to commence for $920 in the Taxation & Commercial Division.

Quicker – 28 day turnaround of reasons for decision

Decisions of the SBTD are to be “fast tracked” so that reasons for decisions will be given to the small business taxpayer usually within twenty-eight days of the hearing where the appeal goes that far. Where practicable an oral decision is to be given at the end of SBTD hearings.

Cheaper – further support for legal costs for SBTD appellants

Although the AAT, and the SBTD and the Taxation & Commercial Division in particular:

- is not a court;

- does not make cost orders;

- isn’t bound by the legal rules of evidence; and

- of itself, imposes no imperative to have legal representation;

the reality is that, where significant tax is in dispute in an appeal to the AAT, most informed appellants are legally represented and present their case in conformity with rules of evidence as if the AAT was a court. The ATO, too, selectively attends the AAT with external legal representation and, if not, ATO officers who conduct cases and appear at the AAT for the ATO are likely to have legal skills and experience. AAT decisions are reported/published and are used as legal precedent. Appellants can, though, more readily request and obtain anonymity from the AAT in tax cases than they can in courts which operate on the principle that justice is to be done in public.

The SBTD initiative partly synchronises the legal representation choice of a small business taxpayer and the ATO in a SBTD case. The ATO has transparent policy positions on when the ATO will use external legal representation in the AAT. The ATO’s position generally is that the ATO will use external legal representation where the case has high legal or factual complexity or where the case has implications for other taxpayers. Where the ATO is to engage legal representation in the SBTD then the ATO:

- must inform the appellant that it proposes to engage external legal representation; and;

- may meet the legal costs of the legal representation of the small business appellant that do not exceed the ATO’s legal costs of its own external legal representation. That is a possibly contentious integer as the ATO has and uses its leverage, which a small business doesn’t have, to negotiate lower fees from legal counsel with expectation of more ATO briefs.

Cheaper – greater opportunity for ATO litigation funding

This opportunity for a small business taxpayer to obtain the assistance of the ATO with their costs of legal representation in the SBTD dovetails with the test case funding policy of the ATO. Like under that policy the decision to assist a small business taxpayer with its legal costs of a SBTD appeal is with the ATO. Where the case has implications for other taxpayers then it is more likely that the ATO will both seek its own external representation and will fund the small business taxpayer’s legal costs up to the same level. Although time will tell, a small business taxpayer appears to be in an enhanced position to obtain ATO assistance with their legal representation costs in the SBTD as compared to taxpayers generally who appeal to the Taxation & Commercial Division of the AAT or who appeal directly to the Federal Court which involves significantly greater costs.

Unlike the Federal Court, the AAT does not order costs. That means that the legal fees and costs of a small business taxpayer running an appeal in the SBTD will only come from the ATO SBDT case funding or ATO test case funding, if not self funded, as legal costs won’t be awarded by the AAT even where the small business taxpayer is successful in a tax appeal case.

ASBFEO already acts as a gateway and assists small businesses to access funding for small business disputes. It is understood that the SBCS will be similarly resourced to act as a gateway to assist small businesses to obtain legal representation funding under both SBTD or ATO test case funding guidelines.