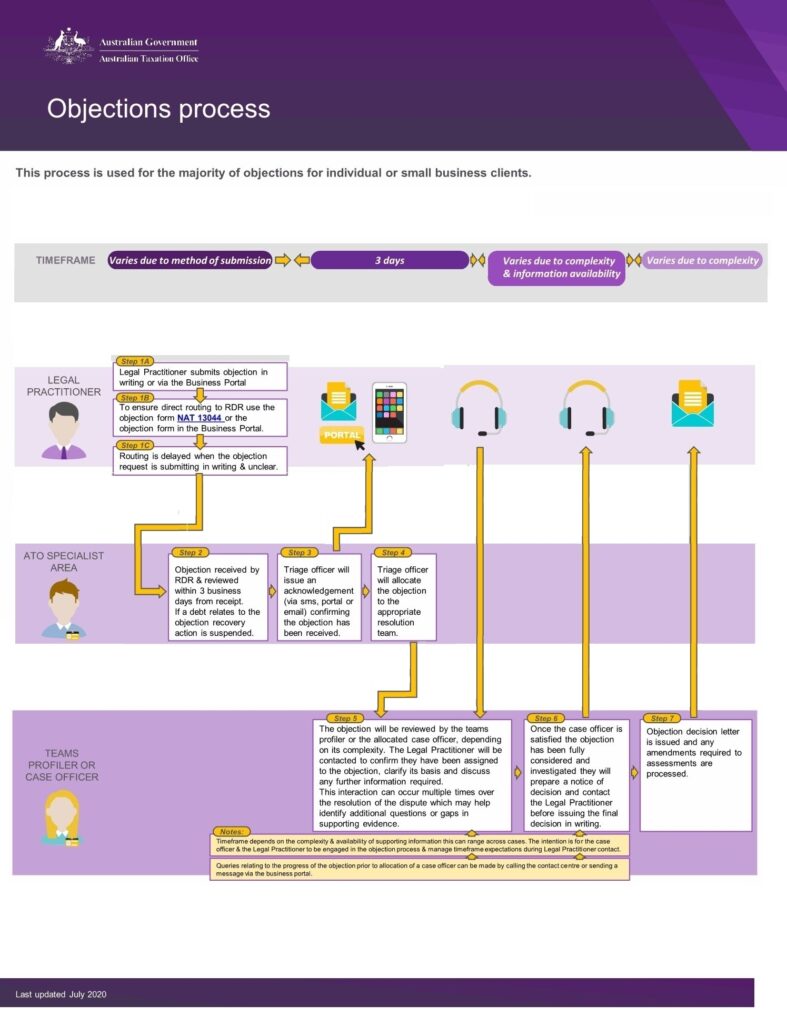

The Australian Taxation Office has recently reviewed how it engages with lawyers. They have released the chart below (best viewed on a large screen) setting out how lawyer-lodged objections for lawyers’ clients progress to decision.

Some comments and explanation

RDR is Review and Dispute Resolution, an ATO section (business line) established by the ATO in 2013.

We have had positive experience of the “triage” process and the aid of competent triage officers to help resolve procedural dilemmas so that the objection officer can focus on the grounds of objection.

The chart encourages lawyers’ use of Objection form – for tax professionals (NAT 13044) to achieve “direct routing”. We have said on this blog why this form is not so helpful. We don’t use this form to prepare an objection for a client and we haven’t had routing trouble we have noticed.