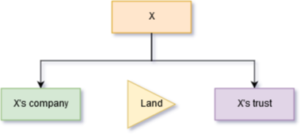

A company controlled by X owns land. X would prefer it if the land was held by a trust or in an individual name such as X or Y, X’s spouse.

Significant capital gains tax (“CGT”) on the transfer of the land is not expected by X and Y. Is a transfer of the land to a trust or to X or Y or both worthwhile? Here are some tax implications X may want to think about:

Capital gains tax

If the land has increased in value X will want to consider CGT more closely:

If the land is not an active asset, or if the small business CGT concessions or the new small business restructure roll-over, can’t apply for some other reason, the value of the land, when disposed of, will be taken into account in determining CGT. i.e. the market value substitution rule will apply in the event of an undervalue transfer of the land. An undervalue transfer of the land is rarely likely to be effective under tax rules.

The small business CGT concessions and the new small business restructure roll-over don’t apply if the asset is not an active asset. The land won’t be an active asset if it is mainly used by the company, and related parties of the company, to earn rent. As the land is held in a company, the 50% CGT discount is not available to the company on the transfer of the land.

Problems with a gift or an undervalue transfer

If full value is not payable to the company for the land then, without more, a transfer of the land could be treated as a dividend taxable in full to the transferee as a shareholder of the company, as a deemed dividend taxable to the transferee as an associate of the shareholders of the company, or may possibly be taxable to the company as a fringe benefit. Further if the company has taken the approach of gift there may be difficulties establishing that the company was legally entitled to give the land away to the transferee if that is what is done. Indications of a gift might give a creditor of the company additional rights to pursue the transferee for the value of the land that belonged to the company especially if the stance of the company is that the transfer was not any sort of dividend or remuneration to X or Y.

A sale of the land by the company for full value is more defensible. The sale can be on terms rather than for cash payable on settlement. If the transferee doesn’t follow through, and pay the value in cash or on the agreed terms, then the sale for value can be treated as a sham and the consequences of undervalue transfer can then follow.

So defensible transfers of the land include:

- sales at full value on (genuine) terms; and

- distribution of the value of the land to the shareholders of the company (not in the form of cash) on the voluntary liquidation of the company.

CGT event A1 – but watch out for CGT event E2 if a transfer to a trust

Usually CGT event A1 is attracted when land is transferred from one beneficial owner to another. CGT event A1 is taken to occur at the time of (in the income year of) the disposal, that is, the time of the transfer unless the transfer is made under a contract. If the transfer occurs under a contract and CGT event A1 applies, CGT event A1 is taken to occur at the time of making of the contract.

This can be significant where a contract and settlement straddle the end of an income year, with the time of the contract bringing forward the capital gain into the earlier income year if CGT event A1 applies. If the transferee is a related trust of the vendor then CGT event E2 can apply rather than CGT event A1. CGT event E2 though, unlike CGT event A1, does not bring forward the time of the CGT event to the time of the contract so, if CGT event E2 applies, the capital gain will be made in the later income year.

Stamp duty on a transfer

Stamp duty varies from state to state but generally applies to acquisitions of land based on the market value of the land, not the price to the transferee/purchaser. Very generally speaking it is usually charged at around 5% of the land value. The states offer limited stamp duty relief when acquisitions occur without a change in ultimate beneficial or economic ownership of the land. For instance, in New South Wales and Victoria relief exists in the form of corporate reconstruction concessions. These concessions are generally not available where the acquisition is by a trust or an individual. Thus stamp duty would need to be budgeted for by X as a further cost of transferring the land.

Goods and services tax

If the company is registered or ought to be registered for the goods and service tax and the land in used in an enterprise carried on by the company then the company may be obliged to charge 10% GST to the transferee on the transfer (taxable supply) of the land. If the transferee is also registered for GST, and will use the land in the transferee’s enterprise, then the transferee can obtain an input tax credit/refund of the GST charged to the transferee. The company and the transferee, if registered for GST, may also:

- be able to claim the GST going concern exemption if they take the necessary steps for the exemption; or

- be members of a GST group;

which would relieve the company of the obligation to charge GST to the transferee.