Challenging conclusive tax assessments

In an earlier blog post we looked at if an objection is needed to amend a tax assessment. We observed that, under the law, an assessment is taken to be correct and conclusive and an objection is the way by which a taxpayer can challenge that concluded correctness under the design of the law.

But, for reasons of convenience, cost and informality, taxpayers and tax agents often seek a request for an amendment of an assessment by the Commissioner of Taxation. But, as stated in our blog post, a request for an amendment is unassertive and the Commissioner has no particular obligation to consider and accede to the request.

Aged tax assessment

If a tax assessment is an aged assessment a taxpayer, who requests an amendment of the assessment, may be prevented by a time limit from obtaining the reduction in tax they seek. The Commissioner can amend an aged assessment of tax, including an amendment to decrease tax sought in a written request for the decrease by a taxpayer, within periods specified in section 170 of the Income Tax Assessment Act 1936. For individual taxpayers, with simpler income tax affairs, the period allowed is two years from the day on which the taxpayer was given notice of the assessment and, for individuals with more complex affairs, it is four years from that day – see items 1 and 4 in the table under sub-section 170(1).

If the period applicable to the taxpayer has expired then the Commissioner is prevented from making the amendment sought in a request for an amendment of the assessment by the taxpayer unless an exception in section 170 applies.

Amendment of an aged assessment following an objection

Time limits for amendments of assessments in section 170 are subject to:

- an exception to give effect to a decision on an objection or an appeal – in Item 6 of the table; and

- an exception where the taxpayer requests an amendment in the approved form before the time limit has been reached even if the Commissioner will not be able to amend the assessment by the time the time limit is reached: sub-section 170(5).

It follows that an objection is the only way to achieve an amendment of an aged assessment of tax if the assessment has aged so far that the applicable section 170 period for amendment has expired and the taxpayer is yet to seek an amendment of the assessment.

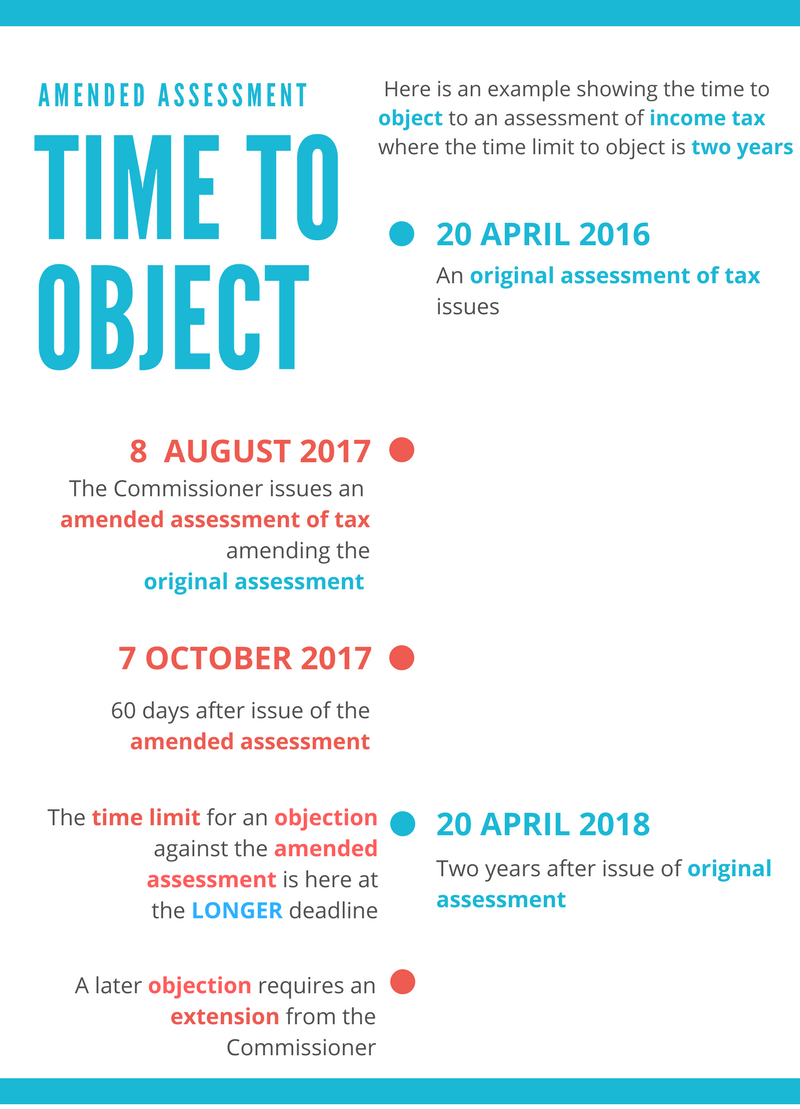

That only way, viz. by objection, has its own distinct time limits which match amendment of assessment time limits but with an important difference which has been in place since 1986 (see NT87/1594 and Commissioner of Taxation [1988] AATA 73; (1988) 19 ATR 3336; 88 ATC 381 at paragraph 22). If a taxpayer seeks to object against an aged assessment, where the applicable section 170 period has expired, then the taxpayer can apply for an extension of time to lodge the objection under section 14ZX of the Taxation Administration Act 1953. In the application the taxpayer must make the case why the extension of time to extend the period in which the objection can be lodged should be allowed. We have looked at late objections in our blog – Is there a time limit for putting in an objection.

The vital difference

So the difference between an objection against an aged assessment and a request for an amendment on an aged assessment, where the statutory time limit to amend or object has expired, is that the Commissioner has the power to:

- allow an application for an extension of time to lodge an objection against an aged assessment;

- allow the objection lodged out of time; and

- amend the relevant assessment accordingly;

but an aged assessment can’t be requested and amended out of time if the time period allowed to the Commissioner to amend the aged assessment has expired.